Due to client confidentiality and a necessary NDA, we couldn’t share the original project details. Instead of letting a strong solution go unseen, we created a reimagined case study based on a parallel, made-up client with identical project demands.

The original project successfully managed a system with complex pricing options, and we immediately saw how well the mechanics transfer to any field involving complicated financial structures. We specifically chose the mortgage field as it provided a visual style and complexity that aligned perfectly with the initial design.

We genuinely enjoyed this process, as it provided a great opportunity to illustrate how our underlying design mechanics and strategic solutions can be easily adapted to solve complex problems in different markets.

Moderate. Proficient with everyday apps but easily frustrated by financial jargon or complex UI.

To establish a clear, trustworthy path to purchasing their first home, calculate maximum affordability, and map the entire mortgage timeline.

Overwhelmed by financial complexity (jargon, risk) and fear of making a costly mistake or missing a critical step.

A Guided Step-by-Step Checklist, clear definitions for industry terms, and interactive tools to visualize payments based on variables.

Moderate to High. Driven, quickly adopting tools that help them achieve their specific financial goal.

To use an investment property strategically (renting it out) to afford a better, permanent home later.

Managing risk and timelines. They worry about tenant management, market changes, and correctly forecasting future equity needed for the upgrade.

Future-focused planning tools (e.g., “Profit-to-Upgrade” calculator), clear visualization of monthly cash flow, and resources to de-risk the rental process.

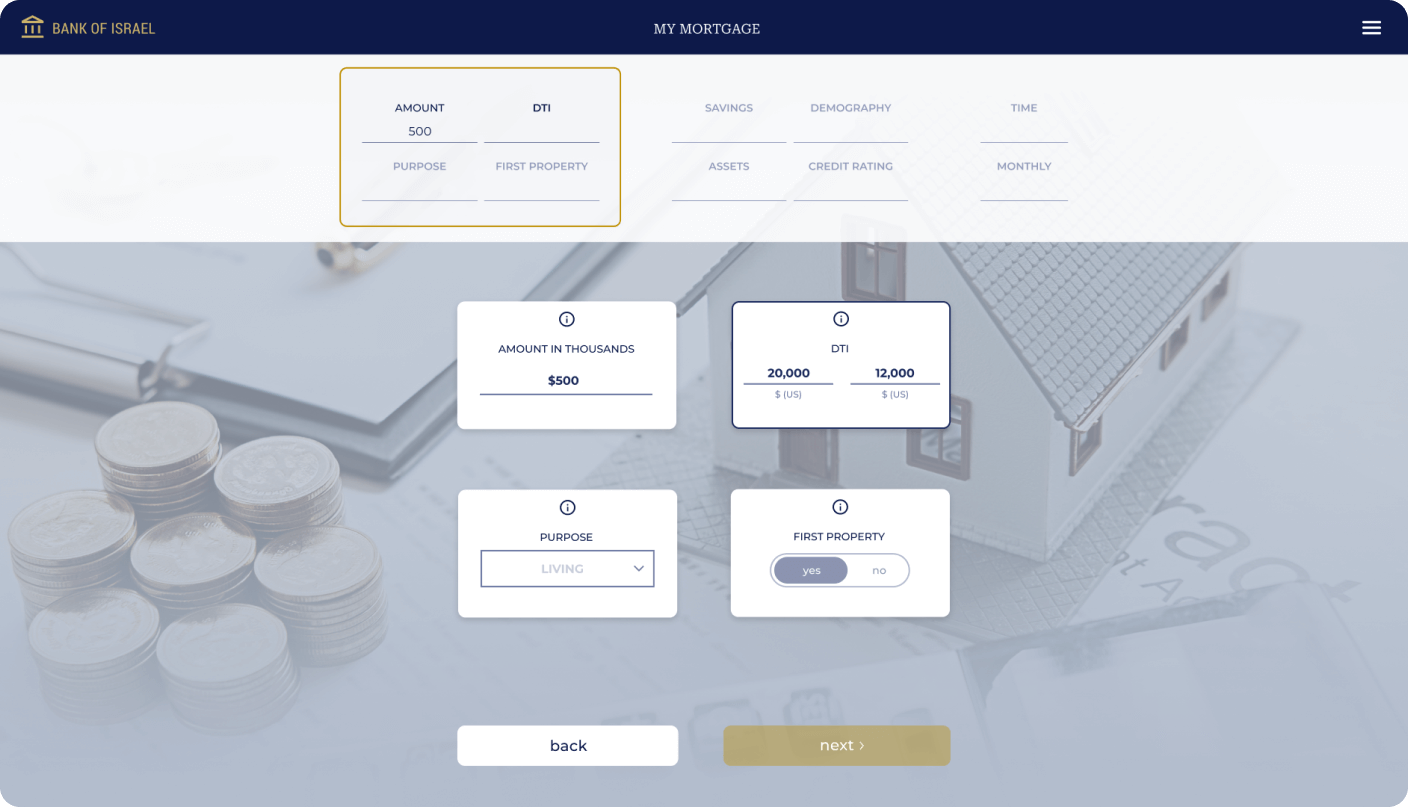

Our solution centers on a strategic, step-by-step questionnaire that cuts through the noise. It is meticulously designed to calculate the optimal course of action for your unique goals. The output provides a preliminary analysis and suggests several suitable mortgage routes, offering a clear and well-defined starting point for your official bank application.

The core challenge was to demystify the complex mortgage application process. We met this by designing a streamlined, step-by-step flow that guides users effortlessly from initial financial input to actionable results. By using a simple, focused UI, clear financial visualizations, and intuitive data entry, the solution delivers confidence and an immediate blueprint for securing a loan, ensuring the user is never lost or overwhelmed by the complexity.

Breaks the mortgage process into a simple, 7-step guided questionnaire, taking users from input to result effortlessly.

Suggests structured options, including a specific number of both Fixed-Rate and Adjustable-Rate routes.

Uses prominent typography to display crucial data and tooltip icons ⓘ for instant definitions of complex terms like tooltip icons.

Our work transformed a complex financial challenge—the mortgage process—into a clear, user-friendly digital experience. We designed a streamlined, step-by-step questionnaire that guides diverse users, from first-time buyers to strategic investors, to an actionable financial blueprint. This solution uses a simple UI and provides immediate clarity via tooltip definitions and suggested mortgage routes, replacing confusion with confidence and providing a validated starting point for securing a loan.